Сайт МКПАО «Т‑Технологии»/IPJSC T‑Technologies website (RUS)

MOSCOW — 20 August 2024.

International public joint stock company TCS Holding (MOEX: TCSG) («TCS», the «Group», the «Holding», the «Company»), a tech leader

in lifestyle and financial services, announces its consolidated IFRS results for the three and six months ended 30 June 2024.

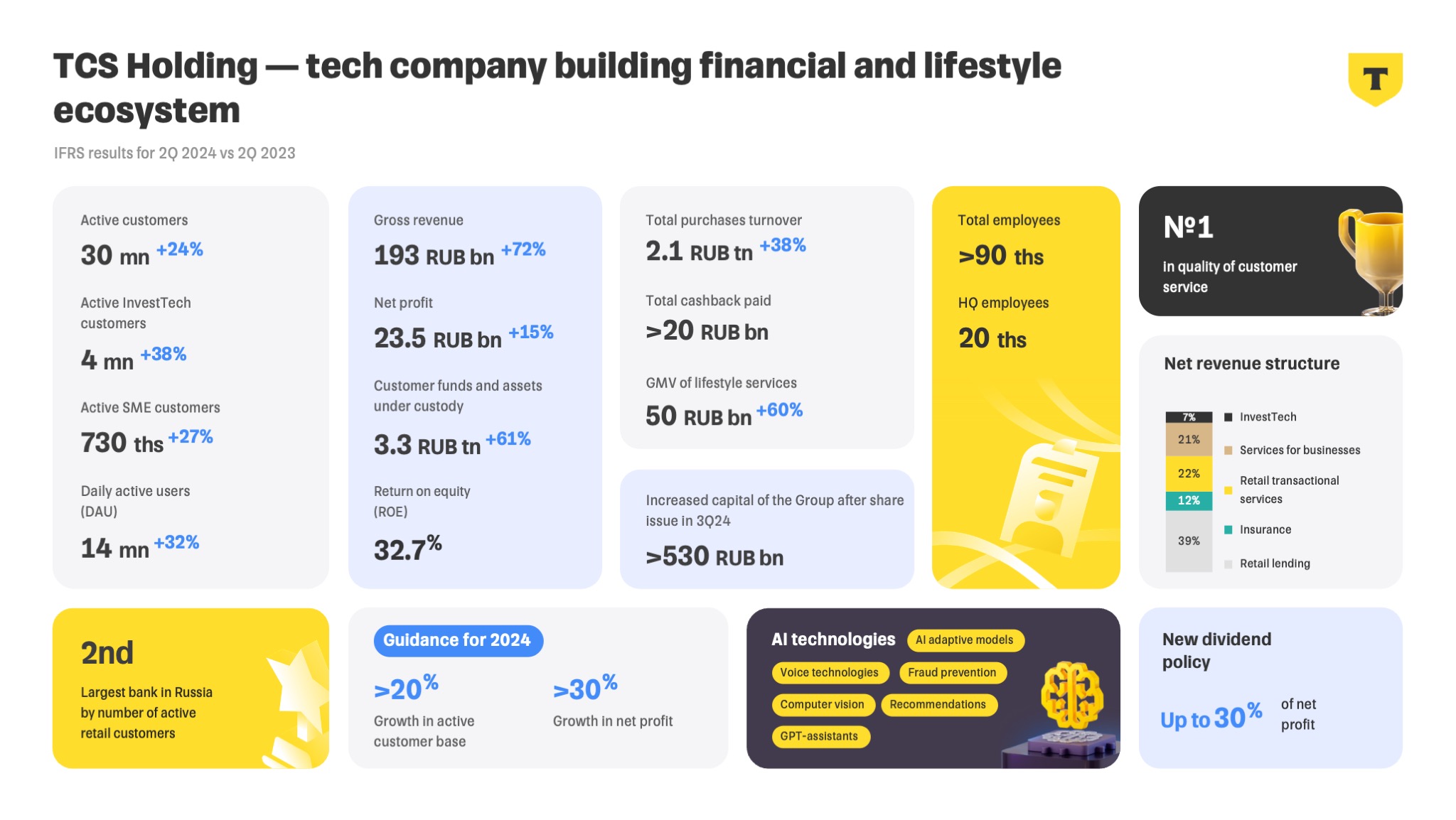

- Total revenues increased 72% to RUB 193.4 bn in 2Q’24 (2Q’23: RUB 112.3 bn)

- Net profit was RUB 23.5 bn in 2Q’24 (2Q’23: RUB 20.4 bn)

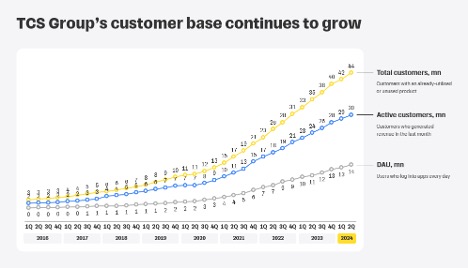

- Total customers rose 24% to 44.0 mn in 2Q’24 (2Q’23: 35.3 mn)

- ROE reached 32.7% in 2Q’24

- The Group adopted a new dividend policy that calls for up to 30% of net profit to be paid out in dividends

The head of Group, Stanislav Bliznyuk, said:

«In the second quarter of 2024, TCS Holding demonstrated robust growth in key business metrics and continued making strategic investments in future growth areas and technological innovations. The number of customers actively using the Group’s products and services each month continues to grow steadily, surpassing the important milestone of 30 million in the second quarter, while the total number of customers rose to 44 million.

In the second quarter, our net credit portfolio increased by 9% compared with the previous quarter, reaching RUB 1.2 trillion. Customer funds grew by 23% over the same period to RUB 2.3 trillion. This once again demonstrates our excellent reliability in the eyes of our customers and their trust. Our balance remains very liquid and profitable as we invest new customer funds in money market instruments that provide solid returns without diverting capital. This is reflected in our return on equity, which rose to 32.7% in the second quarter. Despite external pressures, such as rising market interest rates and tighter lending regulations from the Bank of Russia, we maintain our guidance for net profit growth of more than 30% for the year.

The Group continues to actively invest in strategic technologies and is already among the top players when it comes

to developing and deploying large language models to solve customers’ everyday challenges. The Group’s large language model,

The Chairman of TCS Holding’s Board of Directors, Alexey Malinovsky, said:

«In August, TCS Holding completed the integration of Rosbank — a strategic project designed to consolidate the Group’s financial market position, including through synergies in terms of product offerings for retail and corporate clients. The deal greatly enhances the Group’s capital position, enabling it to accelerate business growth, increase return on equity, and maximise shareholder value.

Based on the premium between the Group’s announced share price for the additional share issue, RUB 3,423.62, and TCS’s current stock

price, Rosbank’s acquisition multiple amounted to 0.8 times its capital. As part of the deal, 69 million new shares were issued,

bringing the Group’s total equity capital to over RUB 530 billion. At the same time, the book value of the Group’s equity

capital per share increased by more than 30% after the additional share issue. TCS Holding’s shareholder structure is highly

diversified, with a significant free float and the share of the largest

The effective use of the capital acquired through this transaction, combined with the ecosystem’s steadily growing base of loyal customers, will enable the Group to successfully execute its growth strategy for the coming years. The Group’s Board of Directors expects management to propose specific steps for the effective integration of Rosbank into TCS Group in the near future».

KEY PERFORMANCE METRICS

|

Key metrics, mn |

2Q’24 |

2Q’23 |

1Q’24 |

|

|

Total customers |

44.0 |

35.3 |

41.9 |

24% |

5% |

Active customers |

30.4 |

24.5 |

29.0 |

24% |

5% |

Monthly active users (MAU) |

30.3 |

25.2 |

29.1 |

20% |

4% |

Daily active users (DAU) |

14.1 |

10.7 |

13.2 |

32% |

7% |

OVERVIEW OF FINANCIAL AND OPERATING PERFORMANCE

|

RUB bn |

2Q’24 |

2Q’23 |

∆ |

1Q’24 |

∆ |

1H’24 |

1H’23 |

∆ |

Interest income |

132.6 |

67.9 |

95% |

113.5 |

17% |

246.1 |

128.1 |

92% |

Interest expense |

-52.5 |

-13.1 |

4.0x |

-38.3 |

37% |

-90.8 |

-25.2 |

3.6x |

|

Net interest income |

77.7 |

53.5 |

45% |

73.2 |

6% |

150.9 |

100.4 |

50% |

|

Net interest income after provisions |

54.8 |

42.4 |

29% |

52.0 |

5% |

106.8 |

77.1 |

39% |

Fee and commission income |

42.2 |

30.2 |

39% |

34.2 |

23% |

76.4 |

56.9 |

34% |

Fee and commission expense |

-18.1 |

-13.6 |

33% |

-15.9 |

14% |

-34.0 |

-23.9 |

42% |

|

Net fee and commission income |

24.0 |

16.6 |

45% |

18.3 |

31% |

42.4 |

33.0 |

28% |

Total operating expenses |

-59.8 |

-45.2 |

32% |

-55.0 |

9% |

-114.8 |

-85.7 |

34% |

Profit before tax |

29.6 |

25.2 |

18% |

28.2 |

5% |

57.9 |

46.1 |

26% |

|

Net profit |

23.5 |

20.4 |

15% |

22.3 |

5% |

45.7 |

36.6 |

25% |

|

Ratios |

2Q’24 |

2Q’23 |

∆ |

1Q’24 |

∆ |

1H’24 |

1H’23 |

∆ |

Return on equity |

32.7% |

35.5% |

-2.8 p.p. |

31.7% |

1 p.p. |

32.0% |

33.0% |

-1 p.p. |

Net interest margin |

12.5% |

13.3% |

-0.8 p.p. |

13.5% |

-1 p.p. |

12.9% |

12.9% |

0.0 p.p. |

Cost of risk |

7.5% |

5.7% |

1.8 p.p. |

7.6% |

-0.1 p.p. |

7.5% |

6.3% |

1.2 p.p. |

|

RUB bn |

30 Jun |

31 Mar |

∆ |

31 Dec |

∆ |

30 Jun |

∆ |

Total assets |

2,884 |

2,438 |

18.3% |

2,270 |

27.0% |

1,753 |

64.5% |

Net loans and advances to customers |

1,190 |

1,088 |

9.3% |

972 |

22.4% |

784 |

51.8% |

Cash and treasury portfolio |

924 |

673 |

37.4% |

724 |

27.6% |

446 |

2.1x |

Total liabilities |

2,588 |

2,159 |

19.9% |

1,986 |

30.3% |

1,514 |

71.0% |

Customer accounts |

2,292 |

1,860 |

23.2% |

1,713 |

33.8% |

1,313 |

74.5% |

Total equity |

296 |

279 |

6.1% |

284 |

4.2% |

239 |

23.6% |

|

Ratios |

30 Jun 2024 |

31 Mar |

∆ |

31 Dec |

∆ |

30 Jun |

∆ |

Share of NPLs |

9.3% |

9.2% |

0.1 p.p. |

9.5% |

-0.2 p.p. |

10.3% |

-1 p.p. |

Tier I capital ratio |

14.3% |

15.2% |

-0.9 p.p. |

16.9% |

-2.6 p.p. |

18.4% |

-4.1 p.p. |

Total capital ratio |

14.3% |

15.2% |

-0.9 p.p. |

16.9% |

-2.6 p.p. |

18.4% |

-4.1 p.p. |

The number of active Group customers increased by 5%

The total customer purchases turnover rose 38%

In 2Q’24, the Group’s total revenue grew by 72%

Gross yield on the loan portfolio reached 27.9% in 2Q’24 (2Q’23: 25.5%) due to rising market interest rates and changes in the structure of loan products. The interest yield on the Group’s securities portfolio increased to 7.6% (2Q’23: 5.6%) due to the growth of interest rates compared with the same period last year.

In 2Q’24, interest expense grew fourfold

In 2Q’24, net interest income grew by 45%

Fee and commission income increased by 39% from a year earlier to RUB 42.2 bn (2Q’23: RUB 30.2 bn). Net fee and commission income grew by 45% to RUB 24.0 bn (2Q’23: RUB 16.6 bn).

The cost of risk increased to 7.5% in 2Q’24, compared with 5.7% in 2Q’23. The

Net operating revenue increased by 41%

At the end of 2Q’24, the Group had:

¾ more than 23 mn active customers in the debit card and current account segment, with total funds in current accounts and other deposits amounting to RUB 1.9 tn;

¾ over 730,000 active customers in the SME segment with a total balance of funds in their accounts of RUB 278 bn;

¾ 4 mn

In 2Q’24, the Group’s total operating expenses increased by 32% from a year earlier to RUB 59.8 bn (2Q’23: RUB 45.2 bn), driven by the expansion of the customer base and investments in IT platforms and talent.

The Group’s net profit increased by 15% in 2Q’24 to RUB 23.5 bn (2Q’23: RUB 20.4 bn). ROE reached 32.7%, improving from 31.7% in 1Q’24 (2Q’23: 35.5%).

As of end of 2Q’24, the Group’s balance sheet showed strong growth. Total assets grew by 65%

The Group’s net loan book increased by 52%

The Group’s NPL ratio was 9.3% (30 Jun ’23: 10.3%). Credit loss allowance coverage was at 1.4x

The Group’s customer funds increased by 75% to RUB 2,292 bn (30 Jun ’23: RUB 1,313 bn).

Total equity increased by 24% to RUB 296 bn (30 Jun ’23: RUB 239 bn) on the back of net profit capitalisation.

DIVIDEND POLICY

The Group has adopted a new dividend policy that provides for the payment of up to 30% of net profit for the year. Considering the conditions outlined in the dividend policy, the Group will aim to declare dividends based on the results of each quarter.

The Group’s financial statements will be available on its website

https://

For enquiries:

Important Legal Information

NOT FOR PUBLICATION, DISTRIBUTION, OR RELEASE, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OF AMERICA, CANADA, AUSTRALIA, JAPAN OR TO ANY PERSON IN ANY OF THESE COUNTRIES OR IN ANY OTHER COUNTRY WHERE SUCH ACTION WOULD VIOLATE THE LAWS OF THE COUNTRY IN QUESTION.

The information and statements contained or referred to in this announcement do not constitute or form part of, and should not be construed as, any public offer under any applicable legislation or an offer to sell or solicitation of any offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. The distribution of this document in certain jurisdictions may be restricted by law. Recipients are required by the Group to inform themselves about and to observe any such restrictions. No liability to any person is accepted in relation to the distribution or possession of this document in any jurisdiction.

Some of the information in this announcement may contain projections or other

About TCS Group

TCS Group is an innovative provider of digital financial and lifestyle services. Branchless since its inception in 2006, TCS

developed a full range of

Related News