Сайт МКПАО «Т‑Технологии»/IPJSC T‑Technologies website (RUS)

Russia, Moscow — 23 May 2022

Tinkoff is delighted to introduce Tinkoff Pay,

an instant payment service that enables quick, easy, convenient and secure purchases of products and services in online and offline

stores without entering your card details.

Tinkoff Pay will bring together the best payment technologies and fintech solutions from the Tinkoff ecosystem for customers and sellers alike.

Tinkoff Pay is available to customers within the Tinkoff ecosystem who have our mobile app; we plan to extend its coverage in the near future to clients of other banks, who will be able to link their card to the service.

Sergey Khromov, Vice President and Head of Tinkoff Checkout:

Tinkoff Pay encapsulates the best products and technologies the Tinkoff ecosystem has to offer, including various cashback combinations from

the Bank and its partners, subscriptions, Tinkoff Target, instalments, split payments and others. In the future, we will integrate this

service with our SuperApp and other banks' cards, as well as with Tinkoff ID, which will soon be launched for our partners.

Embracing the magic of fintech, we are going to turn Tinkoff Pay into a

Tinkoff Pay technologies:

- instant online and offline payments;

- cashback combinations for Tinkoff clients and

non-clients alike; - instalments and split payments using the Dolyame.ru service;

- payments available for customers of all Russian banks;

- biometric solutions for authorisation and instant payments:

- solutions for Tinkoff’s

non-clients ; - integration with Tinkoff SuperApp;

- automatic and regular payments;

- management of all subscriptions in one place;

customer-tailored perks, cashback, etc.;- transaction security on classified platforms;

- integration with the Wallet app;

- p2p transactions and more.

Tinkoff Pay at launch

At launch, Tinkoff customers will be able to use Tinkoff Pay for online and, shortly after, offline payments. Tinkoff Pay online payments have become available to all Tinkoff customers with the latest version of the mobile app; no additional steps are required to connect the service. Purchases made via Tinkoff Pay will earn a cashback equivalent to that earned on card transactions; in the future, we will introduce additional cashback options.

We will be gradually introducing new Tinkoff Pay features over the 2022–2023 period.

Online payments

Tinkoff Pay enables quick and secure payments on the websites and mobile apps of online stores through a smartphone or a PC. At launch, Tinkoff Pay is supported on more than 30,000 online stores partnering with Tinkoff Checkout, including popular online platforms, major retail stores, marketplaces, etc.

Tinkoff Pay advantages for online stores:

- higher success rate of online payments

- greater customer experience — stronger loyalty

- works both in the app and on the website

- easy to sign up

- will later be available to any customer of Russian banks

- cashback and loyalty programmes for customers.

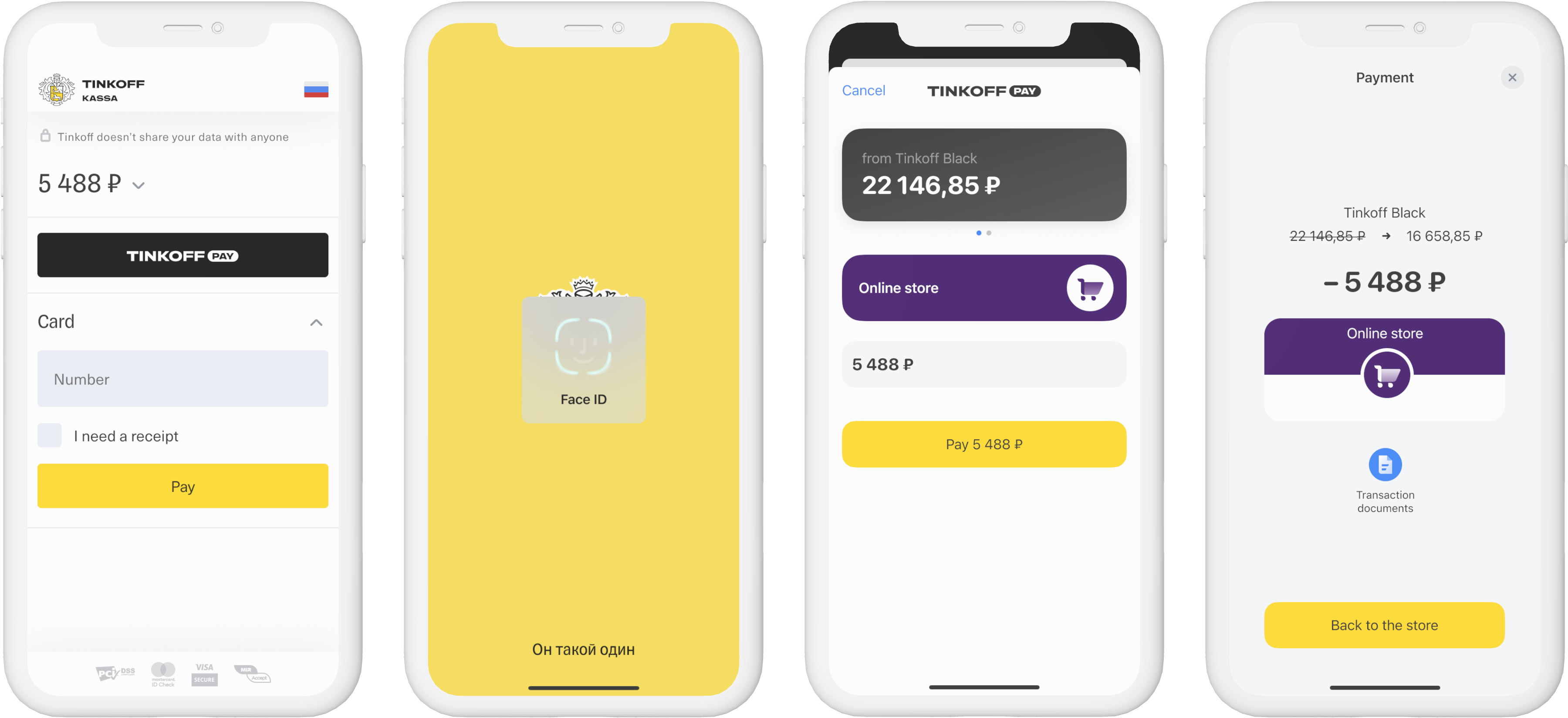

Shopping online

To buy something using your smartphone, you need to click on the Tinkoff Pay button on the payment page. After confirming the transaction (if necessary), the money will be debited from your Tinkoff account. If you have several accounts, you will be able to choose the most convenient one with a sufficient balance.

In the future, you will be able to set up default accounts for different store categories.

You can also make purchases using Tinkoff Pay from your PC. To do this, you will need to scan a QR code with your smartphone, which will take you to the Tinkoff App to confirm the payment.

Cashback

Customers will receive a personalised cashback immediately at the time of purchase — the customer will see the «Pay» button and the amount of cashback. At the launch of Tinkoff Pay, the same cashback applies as with card payments.

When shopping with Tinkoff Pay, customers will be able to receive not only the basic cashback from Tinkoff in various categories, but also other combinations of cashback: increased cashback from partners, manufacturers of specific goods, the outlet where payment is made, etc.

For

Instalments and split payments

At the time of payment, customers will be able to choose whether to pay the entire amount at once or to pay

in instalments. If the shopper decides to pay in instalments or make split payments, they will be able view the

payment schedule by clicking the button. The split payment plan will be integrated with the dedicated Dolyame.ru

Tinkoff Pay knows its customers

Subject to the customer’s consent, Tinkoff Pay will store all data for a quick and smooth purchase: for example, possible delivery addresses, full name, phone number, etc. These details will automatically be prompted in the interface at checkout. The customer will only have to click the «Pay» button.

Shoppers will also be able to pay for purchases literally in a single click, without going to the app and without scanning any QR codes — as soon as they are authorised in the store via the Tinkoff ID service (to be launched later in 2022).

With Tinkoff Pay, customers will be able to automatically pay for and manage subscriptions in their favourite stores and services, as well as in the Tinkoff SuperApp.

The app will show what subscriptions the customer has in Tinkoff Pay which they will be able to manage through one window in the Tinkoff Pay section. The customer can cancel subscriptions, put them on hold if they go on holiday, subscribe to popular stores (by clicking the «Subscribe» button), and so on.

Biometric authorisation

Tinkoff Pay will integrate Tinkoff’s biometric technology. Moving forwards, customers will be able to authorise online and pay offline using facial recognition or similar (additional confirmation in the SuperApp is required for expensive purchases).

Paying offline

Tinkoff Pay will allow you to make contactless payments offline by adding your card or account from any Russian bank.

This solution will also enable customers to personalise their shopping settings: Tinkoff Pay will use the payment source that will offer the

customer the most privileges and bonuses for the given payment through its loyalty programme regardless of the bank of the card used

(e.g.,

Integration with the Wallet

Tinkoff Pay has been integrated into the Wallet app (part of the Tinkoff ecosystem). To pay with the Wallet, all you have to do is to show your bonus or discount card at the checkout and the payment will go through automatically. You will also be able to log in to the Wallet using the Tinkoff ID service.

Transaction security

Tinkoff Pay will also be used in Transaction Security services, thus maximising payment security at websites such as Avito, Youla, etc., while maintaining the convenience and simplicity of the shopping process.

Related News