Сайт МКПАО «Т‑Технологии»/IPJSC T‑Technologies website (RUS)

December 30, 2021

Tinkoff has carried out a major upgrade of its mobile

A wide range of new features and services now enables users of the app to:

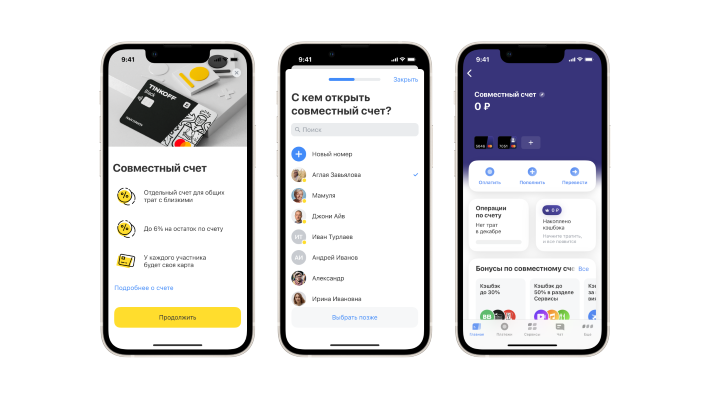

- Open a joint Tinkoff Black account or grant access to an individual account to other Tinkoff customers;

- Upload a QR code certifying vaccination or the presence of antibodies to

COVID-19 , as well as schedule a PCR test for travel purposes; - Sign a credit card agreement directly in the app;

- Activate the Oleg voice assistant and access his services with a quick voice greeting;

- Pull up the money transfer or request function with a shake of the phone;

- Upload and store receipts, pay parking and toll fees, and much more.

Joint Tinkoff Black account

The

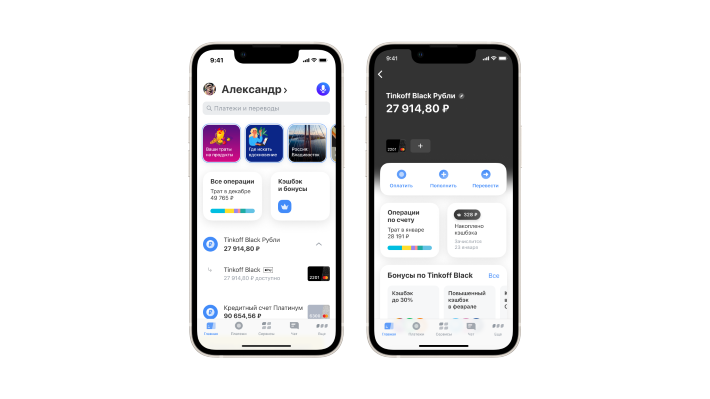

New user home screen

Tinkoff’s new user home screen enables customers to see all key account features and information in one place. This includes the user’s transaction history, information on accumulated cashback, current bonuses and special offers from partners, account details with additional information and activated services, as well as information on free transfer limits to other banks.

The new screen also offers a simplified money transfer process. To receive a money transfer from a card issued by any bank, users can copy a special link or a QR code that appears in their account and send it as a message to the individual making the transfer.

Another new feature enables users to share access to their account with other Tinkoff customers. Users can grant:

- Partial access: another Tinkoff customer will be able to view the account balance;

- Full access: another Tinkoff customer will be able to view the balance, make payments and withdraw money from the account.

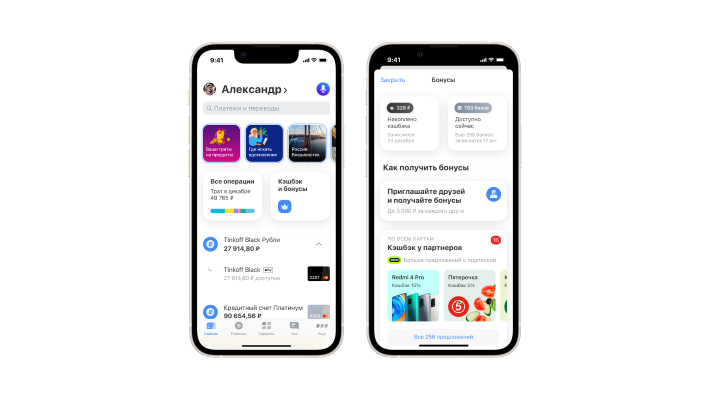

Bonuses on the home screen

The new Bonuses section on the home screen of the app enables customers to view current promotions and special offers from Tinkoff partners, as well as track their accumulated cashback, select increased cashback categories for each month and review their Tinkoff Pro subscription options. All special offers in the feed are personalised and are activated automatically when customers view the Cashback from Partners section.

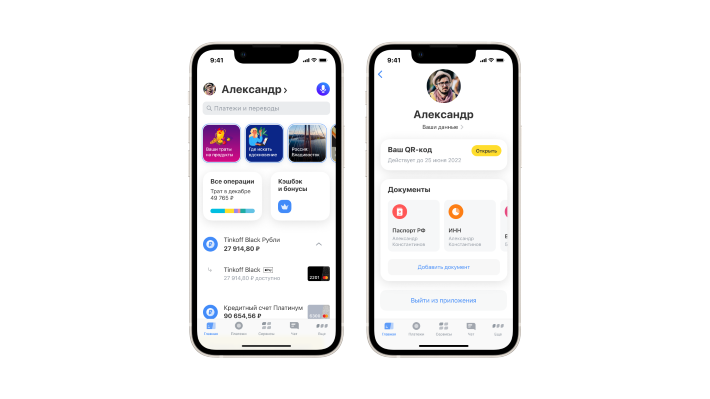

Updated profile section

Tinkoff has integrated the user’s personal profile into the home screen of the

- Change their profile picture;

- Upload a copy of a QR code certifying that they have been vaccinated or have antibodies against

COVID-19 ; - Review and update their personal information, including email, phone number, address, place of work, region of payment and their registration status on the Gosuslugi (Russian public services) website;

- Upload photos of important documents, including their domestic and international passport, SNILS (Insurance Number of Individual Ledger Account), INN (Taxpayer’s ID) and others.

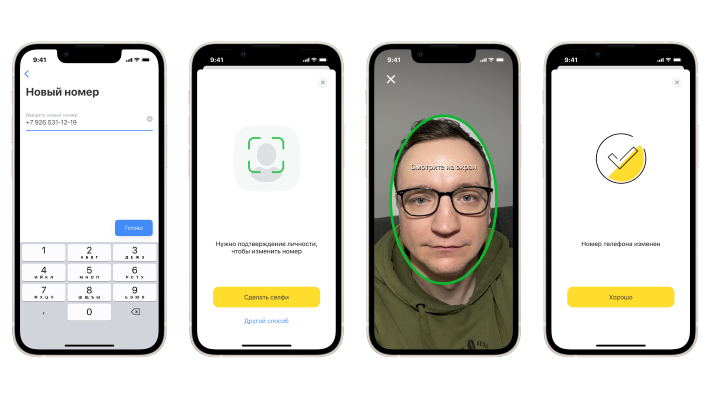

Users whose mobile phone number has changed can update their information in their profile and simultaneously log out of and delete their card from Apple Wallet or Google Pay across all devices. In this case, all QR codes for cash withdrawals previously sent by the user will be voided.

The phone number change function is secured by Tinkoff Protection, which takes into account a variety of security factors, such as the customer’s transaction history and the specifics of his or her personal device. In case of a suspicious transaction, Tinkoff Protection will ask for a selfie to confirm the user’s identity. Tinkoff uses Liveness facial recognition technology to ensure that the device’s camera is pointed at a live person, and not at a photo or video.

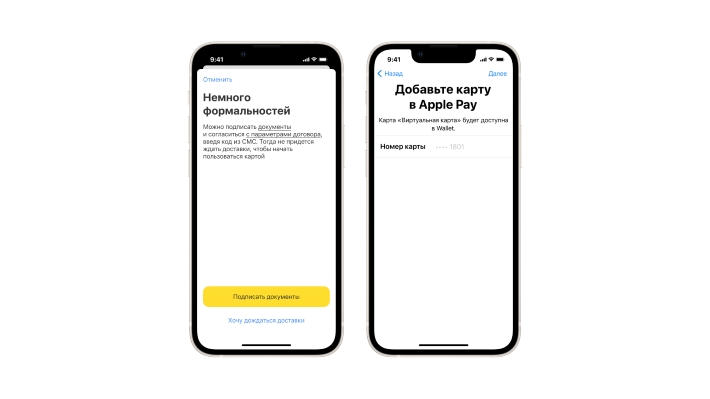

Signing a credit card agreement in the

Customers can sign a credit card agreement via the app without visiting a bank representative — and they can start using their credit card immediately by simply adding it to Apple Wallet or Google Pay.

Send or request money transfer with a shake of the phone

Users can quickly pull up the function to send or request a money transfer by shaking their device when the app is open. This automatically produces a screen where the user can enter the amount to be transferred or requested and select the recipient or sender from their contact list or by entering a phone number manually.

Users can request money from multiple individuals at once by selecting the Open Money Collection option.

This feature is currently available to iOS smartphone users and will be extended to Android users in the near future.

Users can also make a quick payment or transfer via QR code by opening the app, shaking the device and selecting the QR code icon that appears on the screen to scan the code with the camera on their device.

Controlling the Oleg voice assistant through app settings

From January 2022, users can activate or deactivate the Oleg voice assistant through their app settings, in addition to existing options to do so via the support chat of the Tinkoff mobile app or in the Telegram and VKontakte messengers.

If Oleg is activated, users can pull up his services automatically by saying «Hi, Oleg» into their phone when the app is open.

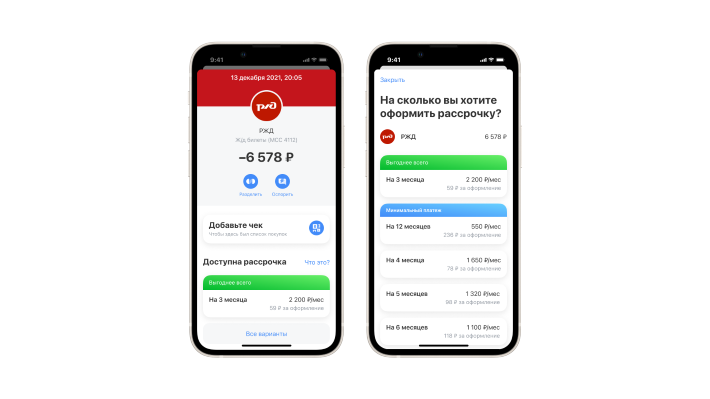

Installment plans available for

To expand its payment services, Tinkoff has added the option for customers to secure an installment plan for eligible items that have already been purchased. In this case, the purchase amount is refunded to the customer’s account, and payment for the item will begin anew under the terms of the installment plan.

Customers can filter their transaction history to view purchases that are eligible for conversion into installment plans with a duration of three to 12 months. Upon the launch of an installment plan, the customer will be offered the option to open a credit account. Customers can issue installment plans for multiple purchases at the same time.

Updated Services section

The Services section of the app has been redesigned to offer more streamlined navigation, in addition to featuring personalised special offers and an individual news feed.

Users can now find services grouped by topics, which include Restaurants, Travel, Beauty, Sports, My Car and many more. To view services that have already been purchased — including cinema or theater tickets, restaurant reservations, or airline tickets and hotel bookings made with Tinkoff Travel — users can visit the Orders section located in the upper right corner of the screen. If the event date changes or a service provider amends the booking, the user will receive a push notification with the updated order status. The order details also display the amount of cashback to be accrued for each purchase.

The Services section has introduced a personalised feed of special offers tailored to each user based on his or her interests, transaction history, geographical location and even the time of day. In addition, users can find a personalised feed of news and analytical articles integrated from Tinkoff Journal, Tinkoff’s digital media platform on financial and lifestyle topics, under the Journal tab of the Services section. The news feed spans the categories of investment, travel, education, auto, business, health, real estate and technology, and generates increasingly more tailored content each time the user engages with the feed.

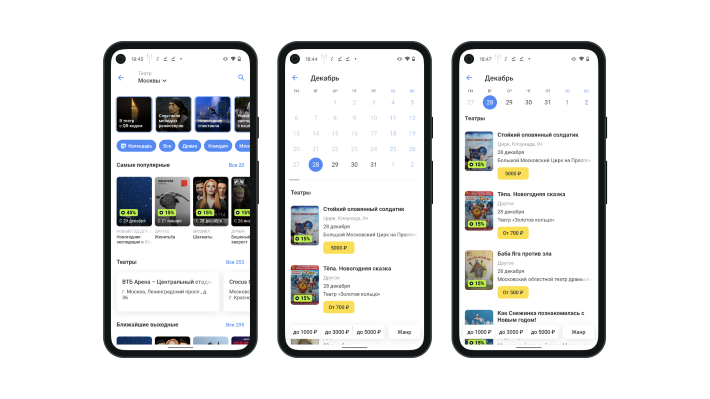

The new Services section additionally offers an Event Calendar that enables users to find and book tickets to cinema, theater, sporting and other events on a particular day. This option is currently available to Android users and will be extended to iOS users in early 2022.

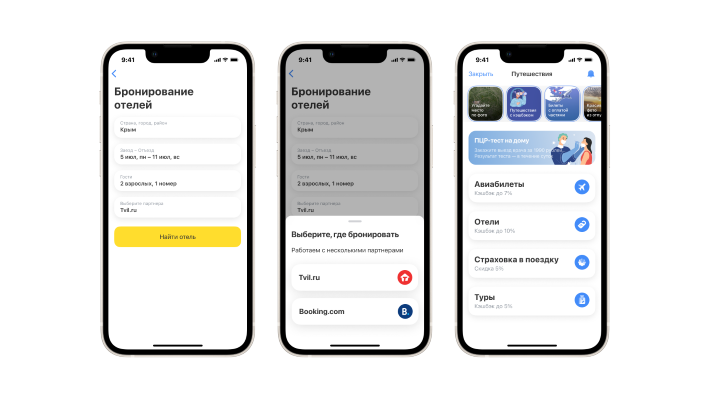

New features from Tinkoff Travel

The Tinkoff Travel section of the app now features expanded information about

The search function in the Flights section now displays the amount of eligible cashback upon the purchase of a specific ticket. Once a ticket is purchased, information about the date and amount of cashback to be received will be displayed in the transaction details.

In addition to the online hotel platform Booking.ru, the Hotel Booking section of the app now features a new partner, Tvil.ru, which offers a wide choice of housing for rent on the Black Sea coast.

When buying tickets to certain destinations, the user is now offered the option to take a PCR test for

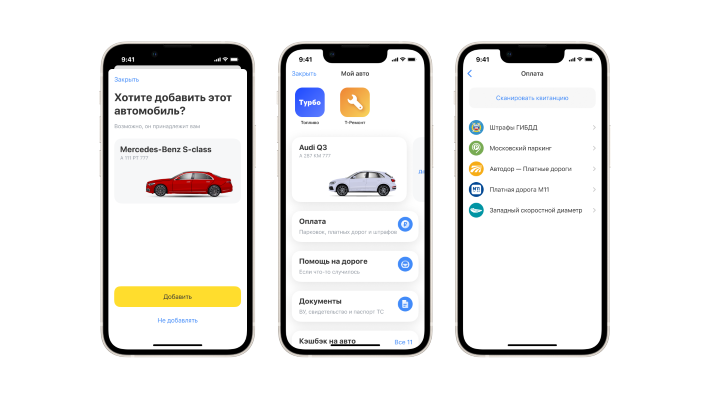

Car information and payments in auto section

The My Car section of the app has been enhanced with a function that automatically pulls up the details of a personal vehicle based on its license plate.

In addition, users can now make parking, toll and fine payments with no commission through the app. Users can simply scan the payment slip with the camera on their device, with no need to enter the payment details manually.

Currency converter built into the search box

To make a quick currency calculation, users can simply enter an amount and the names of the currencies in the search box of the app — for example, «75 dollars in roubles» — and the app will calculate the amount in the desired currency.

Even quicker app login

Users can log into the Tinkoff app with no additional authorisation procedure within five minutes after unlocking their phone with biometric verification.

This feature is now available on iOS and will become available to all users in early 2022. Click here to see a brief video of the new login process.

Receipt uploading and storage

Users can better track their purchases with the option to scan their receipts and store them in the Tinkoff app. This feature can also be used to remedy instances where cashback was mistakenly not credited for a specific item in the receipt.

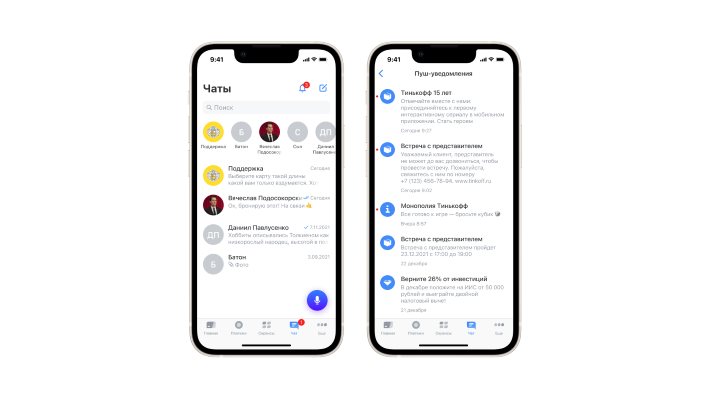

All push notifications in one place

The app features a new section for push notifications that enables the user to view all push notifications from Tinkoff in a single feed.

Related News