Сайт МКПАО «Т‑Технологии»/IPJSC T‑Technologies website (RUS)

MOSCOW — 28 November 2024.

IPJSC

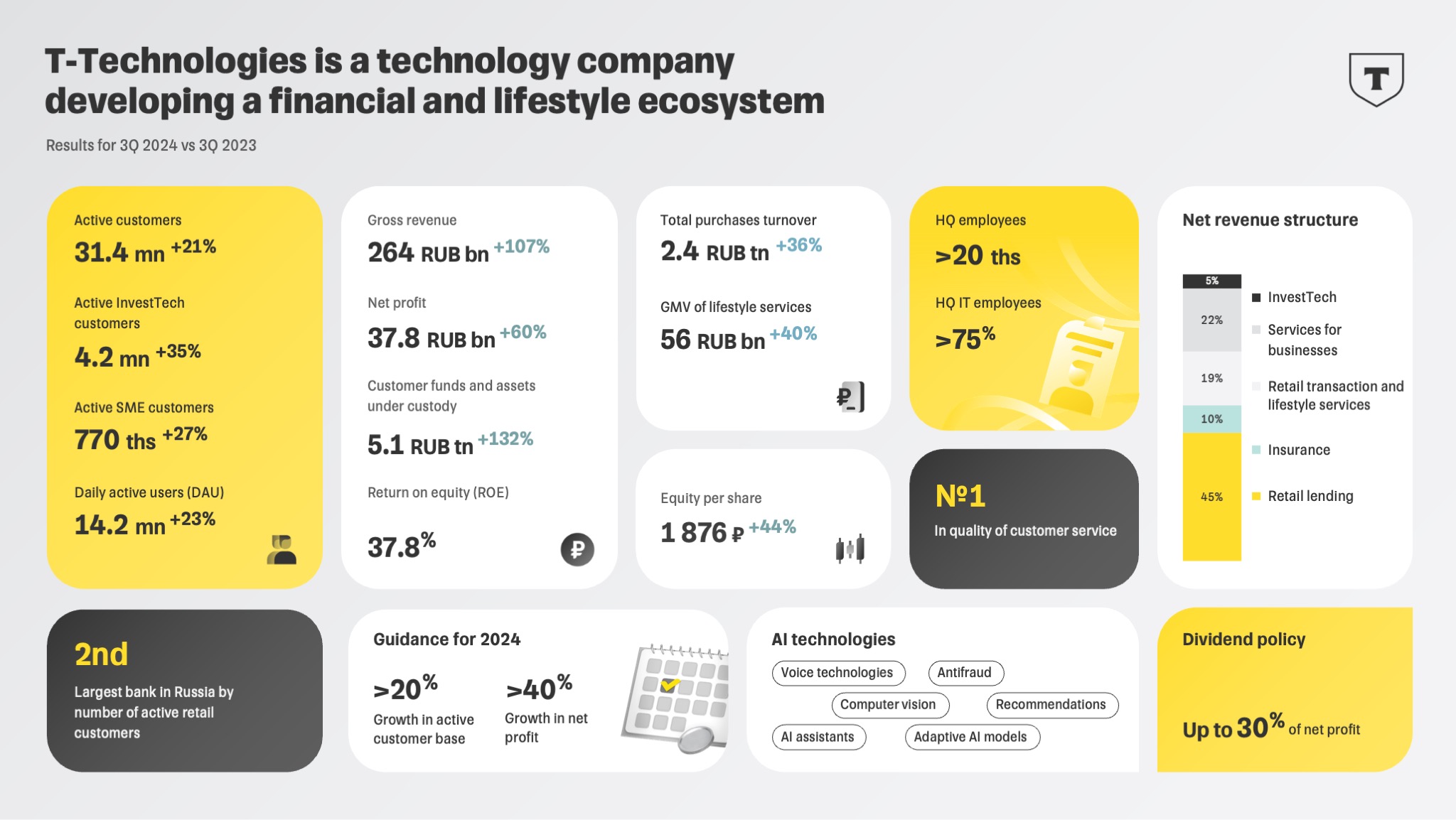

- The Group’s total revenue for 3Q’24 more than doubled to RUB 264.4 bn (3Q’23: RUB 128.0 bn)

- Net profit in 3Q’24 increased by 60% to RUB 37.8 bn (3Q’23: RUB 23.6 bn)

- Total customers rose 21% to 45.7 mn (3Q’23: 37.6 mn)

- Return on equity in 3Q’24 was 37.8%

-

T-Technologies ’ shares began trading on Moscow Exchange under the new ticker T — the firstone-letter stock ticker in Russia

The head of Group, Stanislav Bliznyuk, said:

«Today, our shares became available to investors through every brokerage app under the new ticker T. Together with the Group’s name change

to

We are publishing the Group’s consolidated financial results with the inclusion of Rosbank for the first time. As promised, our

return on equity (ROE) did not decrease but rather grew

Including Rosbank, the Group’s total number of active customers reached 33 million in the reporting period. At the same time,

their transaction activity has been steadily growing, with total turnover from purchases in 9M 2024 increasing by 41%

With the inclusion of Rosbank, we demonstrated solid growth in our key financial metrics in 3Q 2024 amid an increase

in the key rate, highlighting the resilience of our business model to macroeconomic changes.

In the first nine months of 2024, the Group’s net profit including Rosbank rose 39%

1. KEY OPERATING METRICS

T Ecosystem |

3Q |

3Q |

∆ |

2Q |

∆ |

Total customers, mn |

45.7 |

37.6 |

21% |

44.0 |

4% |

Active customers, mn |

31.4 |

26.0 |

21% |

30.4 |

3% |

Monthly active users (MAU), mn |

31.0 |

26.4 |

18% |

30.3 |

2% |

Daily active users (DAU), mn |

14.2 |

11.6 |

23% |

14.1 |

1% |

2. OVERVIEW OF FINANCIAL AND OPERATING PERFORMANCE

RUB bn |

3Q |

3Q |

∆ |

2Q |

∆ |

9M |

9M |

∆ |

Interest income |

193.6 |

78.4 |

2.5x |

132.6 |

46% |

439.7 |

206.5 |

2.1x |

Interest expense |

-86.8 |

-15.2 |

5.7x |

-52.5 |

65% |

-177.6 |

-40.4 |

4.4x |

Net interest income |

103.7 |

61.8 |

68% |

77.7 |

33% |

254.6 |

162.2 |

57% |

Net interest income after provisions |

61.7 |

48.1 |

28% |

54.8 |

13% |

168.5 |

125.2 |

35% |

Fee and commission income |

49.6 |

34.2 |

45% |

42.2 |

18% |

126.0 |

91.2 |

38% |

Fee and commission expense |

-20.1 |

-15.4 |

31% |

-18.1 |

11% |

-54.1 |

-39.3 |

38% |

Net fee and commission income |

29.5 |

18.8 |

57% |

24.0 |

23% |

71.9 |

51.9 |

39% |

Total operating expenses |

-74.8 |

-50.4 |

49% |

-59.8 |

25% |

-189.6 |

-136.1 |

39% |

Profit before tax |

46.2 |

29.9 |

54% |

29.6 |

56% |

104.1 |

76.0 |

37% |

Net profit |

37.8 |

23.6 |

60% |

23.5 |

61% |

83.5 |

60.2 |

39% |

Ratios |

3Q |

3Q |

∆ |

2Q |

∆ |

9M |

9M |

∆ |

Return on equity |

37.8% |

37.8% |

0 p.p. |

32.7% |

5.1 p.p. |

32.7% |

34.7% |

-2 p.p. |

Net interest margin |

11.5% |

14.6% |

-3.1 p.p. |

12.5% |

-1 p.p. |

11.8% |

13.5% |

-1.7 p.p. |

Cost of risk |

8.2% |

6.2% |

2 p.p. |

7.5% |

0.7 p.p. |

7.3% |

6.2% |

1.1 p.p. |

RUB bn |

30 Sep 2024 |

30 Jun 2024 |

∆ |

31 Dec 2023 |

∆ |

30 Sep 2023 |

∆ |

Total assets |

4,967 |

2,884 |

72.3% |

2,270 |

2.2x |

1,917 |

2.6x |

Net loans and advances to customers |

2,597 |

1,190 |

2.2x |

972 |

2.7x |

888 |

2.9x |

Cash and treasury portfolio |

1,267 |

924 |

37.1% |

724 |

75.0% |

465 |

2.7x |

Total liabilities |

4,464 |

2,588 |

72.5% |

1,986 |

2.2x |

1,657 |

2.7x |

Customer accounts |

3,905 |

2,292 |

70.4% |

1,713 |

2.3x |

1,381 |

2.8x |

Total equity |

503 |

296 |

70.1% |

284 |

77.2% |

260 |

93.2% |

Ratios |

30 |

30 Jun 2024 |

∆ |

31 |

∆ |

30 |

∆ |

Share of NPLs |

5.4% |

9.4% |

-4.0 p.p. |

9.5% |

-4.1 p.p. |

9.7% |

-4.3 p.p. |

Tier 1 capital ratio |

13.1% |

14.3% |

-1.2 p.p. |

16.9% |

-3.8 p.p. |

18.0% |

-4.9 p.p. |

Total capital ratio |

13.1% |

14.3% |

-1.2 p.p. |

16.9% |

-3.8 p.p. |

18.0% |

-4.9 p.p. |

The number of active Group customers increased by 3%

Total customer purchases turnover rose 36%

In 3Q’24, the Group’s total revenue more than doubled

Gross yield on the loan portfolio reached 25.9% in 3Q’24 (3Q’23: 25.7%) amid changes in the structure of loan products. The interest yield on the Group’s securities portfolio increased to 9.1% (3Q’23: 6.3%) thanks to higher interest rates compared with the same period last year.

In 3Q’24, interest expense increased by 5.7 times

Net interest income in 3Q’24 rose 68%

Fee and commission income increased by 45%

The cost of risk increased to 8.2% in 3Q’24, up from 6.2% in 3Q’23, due in part to the recognition of Day one provisions for Rosbank’s portfolio. Taking Rosbank’s portfolio into account, the normalised cost of risk was 5.7% for the quarter.

Net operating revenue rose 60%

As of the end of 3Q’24, the Group had:

- more than 24 mn active customers in the debit card and current account segment with total funds in current accounts and other deposits amounting to RUB 2.78 tn;

- 770,000 active customers in the SME segment with a total balance of RUB 396 bn in their accounts;

- 4.2 mn active

T-Investments customers with total assets of RUB 1.2 tn in brokerage accounts.

In 3Q’24, the Group’s total operating expenses increased by 49%

The Group’s net profit in 3Q’24 rose 60%, reaching RUB 37.8 bn (3Q’23: RUB 23.6 bn). Return on equity was 37.8%, improving from 32.7% in 2Q’24 (3Q’23: 37.8%).

As of the end of 3Q’24, total assets had grown by 2.6 times

The Group’s net loan book increased by 2.9 times

The Group’s NPL ratio in 3Q’24 was 5.4% (30 Sep ’23: 9.7%). The NPL coverage ratio was 1.4x.

The Group’s customer funds increased by 2.8 times to RUB 3,905 bn (30 Sep ’23: RUB 1,381 bn).

Total equity rose 93% to RUB 503 bn (30 Sep ’23: RUB 260 bn) due to the issuance of shares for the acquisition of Rosbank and growth in net profit.

The Group’s financial statements will be available on its website:

https://

For enquiries:

The latest information on

Important Legal Information

The information and statements contained or referred to in this announcement do not constitute or form part of, and should not be construed as, any public offer under any applicable legislation or an offer to sell or solicitation of any offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. The distribution of this document in certain jurisdictions may be restricted by law. Recipients are required by the Group to inform themselves about and to observe any such restrictions. No liability to any person is accepted in relation to the distribution or possession of this document in any jurisdiction.

Some of the information in this announcement may contain projections or other

About

Related News