Сайт МКПАО «Т‑Технологии»/IPJSC T‑Technologies website (RUS)

Moscow, Russia — 28 October 2022.

Tinkoff has launched a new initiative aimed at improving financial literacy among people in Russia that teaches them how to develop a healthy attitude to money, and promotes good financial habits.

The initiative will be rolled out on the Tinkoff Journal portal, which has an audience of over 17 million readers, making it Russia’s largest

Tinkoff has also launched a campaign called ‘Financial Health’ (pravila.tinkoff.ru), featuring celebrities such as coach Leonid Slutsky, actress Roza Khairullina, and bloggers Denis and Lena Kukoyaki and Polya Iz Derevki. Through this collaboration, Tinkoff aims to investigate how to stay financially healthy and explores the major enablers and blockers in achieving this.

Nikita Yukovich, Chief Editor of Tinkoff Journal;

«While working on articles on financial literacy, our team realised that many financial problems are rooted, not in knowledge as such but rather in the mentality and habits that prevent us from building a healthy relationship with money. What’s more, this is something we are often unaware of.

To help people manage their money and financial instruments in a way that is right and efficient, we need a holistic approach aimed at fostering good habits and raising awareness about these instruments. Our initial results confirm that this strategy is working.»

The Tinkoff Journal financial literacy initiative currently comprises of the following programmes:

Financial Checkup — a test to assess your financial health, identify strengths and get recommendations on how to increase your financial wellness.

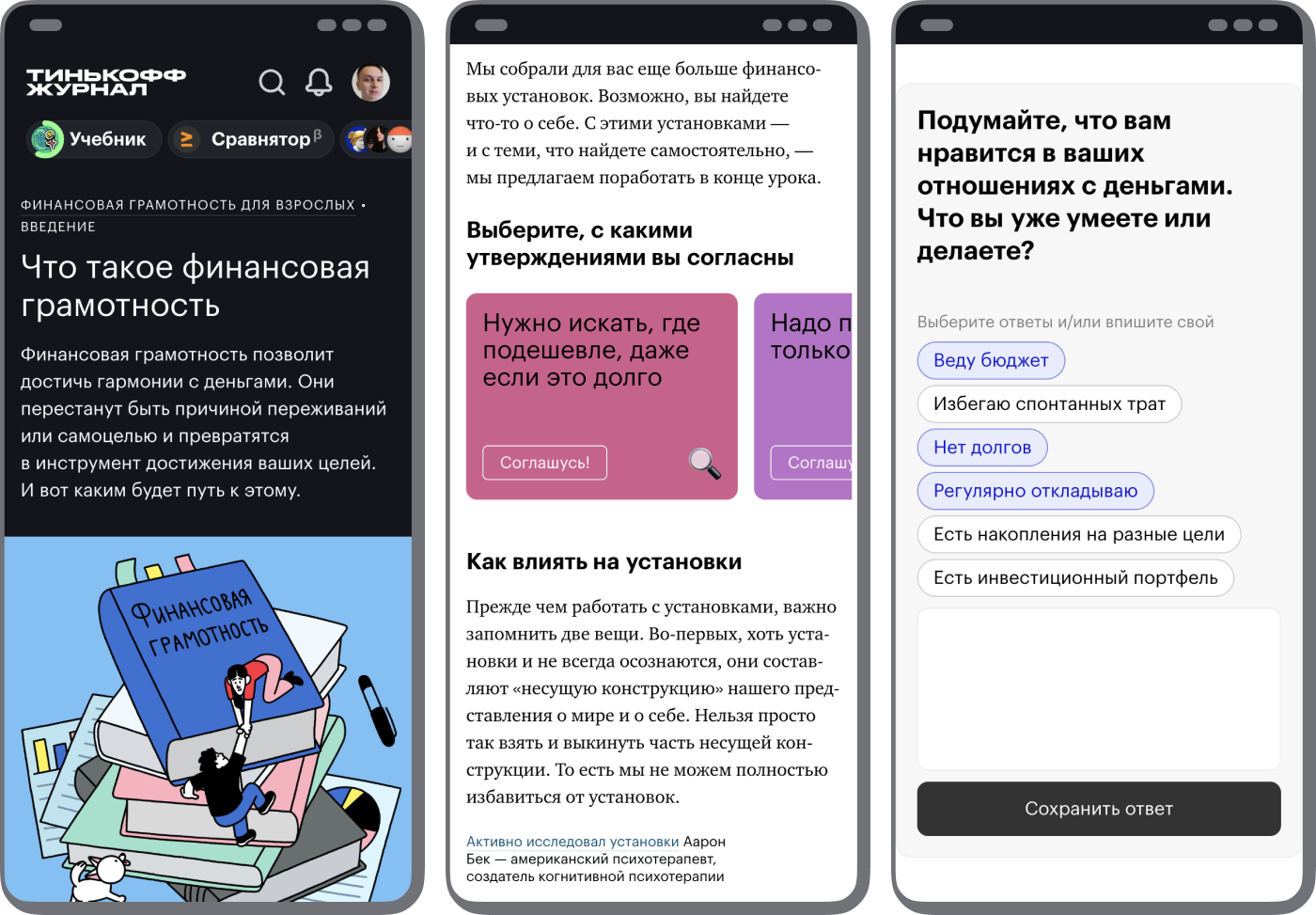

Financial literacy course for adults — a training course aimed at Russians who are worried about their money. It is a course for those who want to start afresh and are striving for financial independence, but are unable to save, aretired of the debts and late payments on their loans, or those who are ready to start investing but don’t know how.

The course consists of ten lessons, each featuring a theoretical element alongside practical tasks and life hacks to help people improve their financial status, e.g. how to create a budget and not break it in five days.

Developed jointly by the editorial staff of Tinkoff Journal and external experts in financial psychology, the course is the culmination of the Journal’s

How to Talk to Kids About Money is a course that will help parents become financial mentors for their children, by teaching them the basics of managing their finances independently, earning money, valuing their work, using credit cards, avoiding debts, and saving for bigger goals.

The course includes six lessons that cover a wide range of topics, from paying utility bills to investing. The materials were put together by a financial educator who spent 15 years pursuing a professional career in the financial market and now helps adults and children better manage their money. All the texts and exercises were additionally verified by a psychologist, who specialises in play therapy and communication with children.

Lessons are already available on the Tinkoff Journal website and will soon also be launched on the mobile app.

The Tinkoff Journal Reality Show is a chance for readers to share stories about their own journey towards their financial goals and the challenges they have faced, or are facing along the way, for example in terms of buying a home, repaying mortgage loans, increasing business revenues, or saving money by breeding chickens, to name just a few. These stories are not a

Nikita Yukovich, Chief Editor of Tinkoff Journal

«Some eight or nine years ago, I was in a black hole of debt. I got there because my business went bust and I didn’t know how to manage money. All this took a long time to fix, but the experience has made it possible for me to write this.

Here’s my takeaway for you: if you don’t work on improving your relationship with money, you might well end up spending what are meant to be the best years of your life repaying debts instead of having fun. I want as many people as possible to learn this from the mistakes of others, rather than from their own. This is why, together with theTextbook team, which is our standalone project on how to manage money, we have combined the entire experience of Tinkoff Journal to bring you this series of materials. They are perfect both for those who are only beginning to think about their relationship with money, and for those who have been with us since day one and have already learnt a lot.»

Public figures that feature on the Financial Health project explain how

In line with its commitment to financial literacy, Tinkoff is also working on the following other products:

- A series of articles, calculators, and Tinkoff Journal educational courses on financial literacy and security. For example, we have courses on how to invest, avoid scams, or take out a mortgage loan that offers good value for money, along with a tool to check whether a potential investment offer is a pyramid scheme (Pyramidometer), and much more.

- Materials aimed at raising awareness about financial security by Tinkoff Protection, including an educational cartoon entitled Vegetables in the Garden, articles in our blog on security, instructions on how to avoid fraudsters available on the Tinkoff website, and stories and push notifications in the Tinkoff app.

Related News