Сайт МКПАО «Т‑Технологии»/IPJSC T‑Technologies website (RUS)

Moscow, Russia, 23 November 2021.

Tinkoff Capital Management Company has launched Tinkoff Eurobonds EUR, a new

The fund’s portfolio includes Eurobonds issued in over 20 countries. Most of these instruments are

Among other securities, the fund invests in perpetual Eurobonds issued by Raiffeisen Bank International AG, one Austria’s top banks,

as well as

The fund follows the

Tinkoff Aggregate Eurobond High Yield Index EUR*, which tracks the aggregate yield of a portfolio made up of

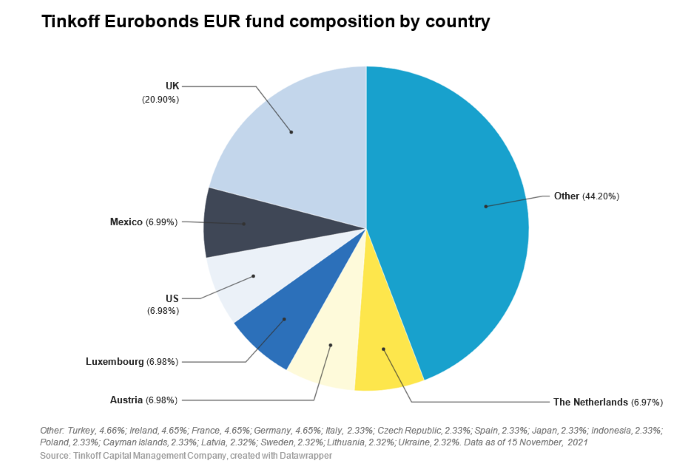

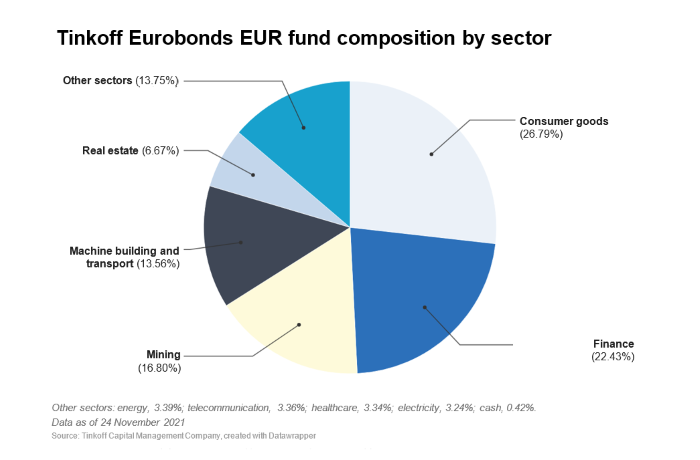

The fund is well diversified both by country and by sector. Producers of consumer goods make up almost 21% of its bond portfolio; the financial sector, another 21%; and the mining sector, 9.3%. In terms of geography, the share of UK companies is 21%, and companies in the United States, Austria, Mexico, Luxembourg and the Netherlands account for 7% each.

«The Tinkoff Eurobonds EUR fund gives investors an opportunity to diversify their currency risks. Tinkoff Investments analysts estimate the fund’s potential return at about 3% per annum, while the current average rates on EUR deposits stand at 0.1% or below.

«Most Eurobonds in the fund’s portfolio are

«In addition, the Eurobond market is usually unavailable to unqualified investors, and the minimum investment is fairly high — EUR 100,000 on average — while the starting price of Tinkoff Eurobonds EUR units is just EUR 10. Therefore, exposure to the Eurobond market via the fund is a decent and cheaper alternative to purchasing Eurobonds independently.»

Funds can be purchased through the Tinkoff Investments mobile app in the «What to Buy» → «Funds» section. They can also be purchased on the Tinkoff Investments website or through the Tinkoff Investments web terminal.

The Tinkoff Eurobonds EUR fund is available at all Tinkoff Investments rates with no brokerage fees for buying or selling units on the Tinkoff Investments platform.

*The Tinkoff Aggregate Eurobond High Yield Index EUR is calculated by Tinkoff Bank JSC

Securities and other financial instruments mentioned in this overview are for informational purposes only. This review is not an investment idea, advice, recommendation, offer to buy or sell securities or other financial instruments.

Disclaimer Full Text

Tinkoff Capital LLC. Licence No. 21-

Before purchasing an investment unit, please carefully read the rules for the mutual fund’s fiduciary management. For detailed information on Tinkoff Capital LLC and the mutual funds under its management, including trust management rules and all amendments and supplements thereto, as well as information on applications for the purchase, redemption and exchange of investment units, please contact us at: 5 Golovinskoye Shosse, Bld. 1, Floor 19, Room 19018, Moscow, 125212, www.tinkoffcapital.ru, phone: +7 499 704 06 13.

ETF RFI Tinkoff Eurobonds EUR Index. Trust Management Rules No. 4618, registered by the Central Bank of Russia on 27 September 2021.

Related News