Сайт МКПАО «Т‑Технологии»/IPJSC T‑Technologies website (RUS)

MOSCOW — 20 March 2025.

IPJSC

-

Revenue in 2024 doubled

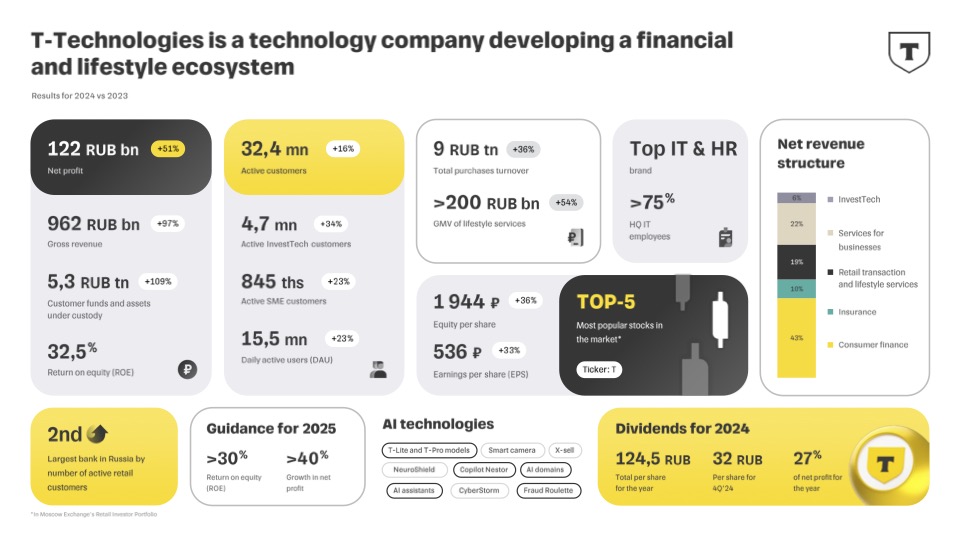

year-on-year to a record RUB 962 bn. Revenue in Q4’24 increased 2.3xyear-on-year to RUB 338 bn. -

Net profit in 2024 grew by 51%

year-on-year to RUB 122 bn. In 4Q’24, net profit increased by 87%year-on-year to RUB 39 bn. - Return on equity in 2024 amounted to 32.5% (4Q’24: 30.2%).

-

The number of customers using the T ecosystem grew by 18%

year-on-year to 48 million by the end of 2024. - The Group’s Board of Directors recommended paying out dividends in the amount of RUB 32 per share based on 4Q24 results.

- For 2025, the Group expects net profit growth of at least 40% with a return on equity of over 30%.

The President of

«I am pleased to present the Group’s strong financial results for 2024 and to highlight for our shareholders our company’s key priorities for the coming periods. For the first time in its history, T Group surpassed the symbolic milestone of $1 billion in net profit, exceeding our initial forecast by more than 20%. The Group also increased its total customer base by 18% to 48 million by the end of the year and get close to RUB 1 trillion in annual revenue.

Alongside with improved performance in other key metrics, this perfectly demonstrates our focus on the leading financial and lifestyle

services development with high efficiency — based on advanced technology platforms and

In 2024, the Group successfully carried out the

Our focus on growth efficiency as well as the credit and transaction activity of our expanding customer base drove significant gains across key financial metrics in 2024, with revenue doubling and net profit increasing 1.5x. The Group traditionally demonstrated a high level of profitability and business returns: the return on equity for the year amounted to 32.5%.

Today, the T ecosystem is already serving 48 million customers. Half of our active customers use at least two of our services, and one in two new customers joins us through a referral from an existing customer. These are the best indicators of the user experience in our ecosystem. Loyalty to T has long extended beyond just digital banking: last year, our customers spent more than RUB 200 billion in the T ecosystem on products, tickets, hotels and other lifestyle purchases generated through our app.

In 2025, we plan to continue seeking new opportunities to leverage technology to drive growth and efficiency. Within a year, every T employee will be using copilots in their work, and 25% of the company’s code will be written with the help AI.

Thanks to the adoption of new technologies and ongoing business growth with a focus on efficiency, we already expect net

profit growth of at least 40% for

The Chairman of the Board of Directors of

«In 2024, we implemented a number of strategic projects that will determine the Group’s growth trajectory in the

coming years. The Group’s holding company was

Amid the

As a technology company, the Group adheres to best practices in

One of the most important events of the past year for our shareholders was the Group’s decision to start making regular

dividend payments again. By resolution of the Board of Directors, the Group aims to allocate up to 30% of its

annual net profit to dividends, striking a balance between the company’s growth potential and a consistent return

on investment for shareholders. With this in mind and in line with our previously announced plans, the Board of Directors has

recommended paying shareholders a dividend for the fourth quarter of 2024 in the amount of RUB 32 per share. Including the

interim dividends that T shareholders received in December, we expect the total dividends paid out by the Group for

1. KEY OPERATING METRICS

|

T Ecosystem |

4Q |

4Q |

∆ |

3Q |

∆ |

Total customers, mn |

47.8 |

40.4 |

18% |

45.7 |

4.5% |

Active customers |

32.4 |

27.9 |

16% |

31.4 |

3.2% |

Monthly active users (MAU), mn |

32.5 |

28.2 |

15% |

31.0 |

4.9% |

Daily active users (DAU), mn |

15.5 |

12.7 |

23% |

14.2 |

9.3% |

2. OVERVIEW OF FINANCIAL AND OPERATING PERFORMANCE

|

RUB bn |

4Q |

4Q |

∆ |

3Q |

∆ |

2024 |

2023 |

∆ |

Interest income |

253 |

94 |

2.7x |

194 |

31% |

693 |

300 |

2.3x |

Interest expense |

-124 |

-24 |

5.2x |

-87 |

43% |

-302 |

-64 |

4.7x |

|

Net interest income |

125 |

68 |

84% |

104 |

21% |

380 |

230 |

65% |

|

Net interest income after provisions |

82 |

55 |

49% |

62 |

32% |

250 |

180 |

39% |

Fee and commission Income |

56 |

37 |

53% |

50 |

14% |

182 |

128 |

42% |

Fee and commission expense |

-23 |

-16 |

44% |

-20 |

13% |

-77 |

-55 |

40% |

|

Net fee and commission income |

34 |

21 |

59% |

29 |

14% |

106 |

73 |

45% |

Total operating expenses |

-89 |

-57 |

56% |

-75 |

19% |

-279 |

-193 |

44% |

Profit before tax |

48 |

27 |

77% |

46 |

4.4% |

152 |

103 |

47% |

|

Net profit |

39 |

21 |

87% |

38 |

2.4% |

122 |

81 |

51% |

|

Ratios |

4Q |

4Q |

∆ |

3Q |

∆ |

2024 |

2023 |

∆ |

Return on equity |

30.2% |

30.4% |

-0.2 p.p. |

37.8% |

-7.6 p.p. |

32.5% |

33.5% |

-1 p.p. |

Net interest margin |

11.0% |

14.2% |

-3.2 p.p. |

11.6% |

-0.6 p.p. |

11.8% |

13.6% |

-1.8 p.p. |

Cost of risk |

6.5% |

5.9% |

0.6 p.p. |

8.2% |

-1.7 p.p. |

7.3% |

6.2% |

1.1 p.p. |

|

RUB bn |

31 Dec 2024 |

30 Sep 2024 |

∆ |

31 Dec 23 |

∆ |

Total assets |

5,118 |

4,967 |

3.0% |

2,270 |

2.3x |

Net loans and advances to customers |

2,537 |

2,597 |

-2.3% |

972 |

2.6x |

Cash and cash equivalents |

1,427 |

1,267 |

12.6% |

724 |

97% |

Total liabilities |

4,597 |

4,464 |

3.0% |

1,986 |

2.3x |

Customer accounts |

4,010 |

3,905 |

2.7% |

1,713 |

2.3x |

Total equity |

521 |

503 |

3.6% |

284 |

84% |

|

Ratios |

31 Dec 2024 |

30 Sep 2024 |

∆ |

31 Dec 2023 |

∆ |

Share of NPLs |

5.8% |

5.4% |

0.4 p.p. |

9.5% |

-3.7 p.p. |

Tier 1 capital ratio |

12.9% |

13.1% |

-0.2 p.p. |

16.9% |

-4.0 p.p. |

Total capital ratio |

12.9% |

13.1% |

-0.2 p.p. |

16.9% |

-4.0 p.p. |

The number of active

Total turnover from customer purchases in 2024 rose 36% to nearly RUB 9 tn. The GMV of our transactional and lifestyle services (such

as City and Travel) grew by 54%

In 2024,

In 4Q’24, the gross yield on the loan portfolio was 25.8% (4Q’23: 26.6% in 4Q 2023), reflecting changes in the structure of loan products. The Group’s yield on its securities portfolio increased to 11% (4Q’23: 7.3%).

In 2024, interest expense increased by 4.7x

The cost of borrowing increased to 10.5% in 2024 (2023: 4.5%), reaching 11.9% in 4Q (4Q’23: 5.9%), reflecting higher market interest rates.

In 2024, net interest income increased by 65%

Fee and commission income rose 42%

The cost of risk increased to 7.3% in 2024 (2023: 6.2%) and to 6.5% in 4Q’24, versus 8.2% in the previous quarter

(4Q’23: 5.9%). The

Net operating revenue grew 57%

As of the end of 4Q’24, the Group had:

- more than 40.2 mn customers with total funds in current accounts and other deposits amounting to RUB 3,2 bn;

- over 1.5 mn customers in the SME segment, with a total balance of RUB 337 bn in their accounts; and

-

more than 7.9 mn

T-Investments customers, with a total asset volume of 1.4 tn rubles in brokerage accounts.

In 2024, total operating expenses increased by 44%

The Group’s net profit grew by 51% in 2024 to a record RUB 122 bn (4Q’24: RUB 39 bn, an 87%

In 2024,

The Group’s net loan portfolio increased 2.6x

The Group’s NPL ratio was 5.8% (31 December 2023: 9.5%). The NPL coverage ratio was 140% as of 31 December 2024 (unchanged compared to the figure as of December 31, 2023).

The Group’s customer funds grew 2.3x to RUB 4,010 bn as of 31 December 2024 (31 December 2023: RUB 1,713 bn).

The Group’s total equity increased by 84% to RUB 521 bn (31 December 2023: 284 bn), driven by the retention of net profits.

The Group’s financial statements will be available on its website:

https://

For enquiries:

Current information on

Important Legal Information

The information and statements contained or referred to in this announcement do not constitute or form part of, and should not be construed as, any public offer under any applicable legislation or an offer to sell or solicitation of any offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. The distribution of this document in certain jurisdictions may be restricted by law. Recipients are required by the Group to inform themselves about and to observe any such restrictions. No liability to any person is accepted in relation to the distribution or possession of this document in any jurisdiction.

Some of the information in this announcement may contain projections or other

About

Related News