Сайт МКПАО «Т‑Технологии»/IPJSC T‑Technologies website (RUS)

Moscow, Russia, 15 November 2021.

Tinkoff Capital Management Company has launched three new

- Tinkoff

AI-Robotics for investments in artificial intelligence and robotics technology leaders -

Tinkoff FinTech for investments in companies in one of

fastest-growing business segments — financial technology -

Tinkoff

PAN-ASIA for investments in securities of the largest issuers in the rapidly developingAsia-Pacific region

Many companies in the funds are closed to unqualified investors.

The Tinkoff

Companies in the fund operate in all spheres of robotics and artificial intelligence production and maintenance. They include Ambarella Inc., specialising in imaging, video and computer vision processors, and Dynatrace, a service provider for IT infrastructure performance monitoring. The fund follows the Nasdaq CTA US AI & Robotics TR Index. Since 2016, the strategy has produced an annual yield, in USD, of 30.2%.

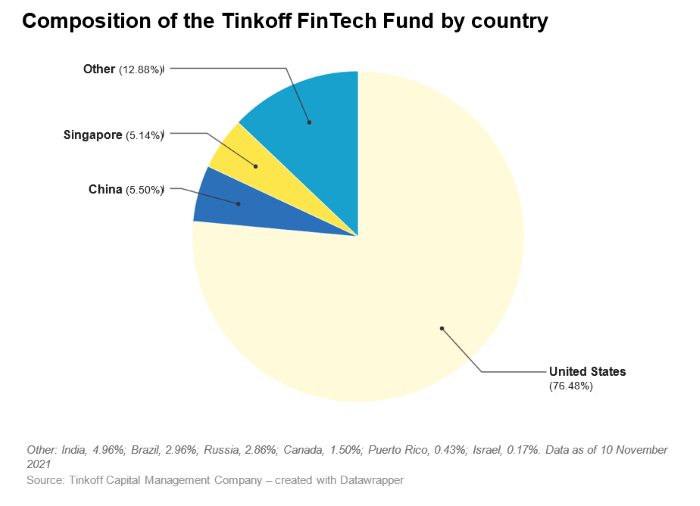

The Tinkoff FinTech ETF invests in shares in fintech companies. It brings together financial services and innovative

The fund’s companies include PayPal Holdings, the world’s largest debit electronic payment system; Coinbase, which operates a cryptocurrency exchange platform; and TCS Group, the parent company of Tinkoff, the world’s largest independent online bank, with more than 17 million customers.

The fund follows the Tinkoff FinTech Total Return Index USD, which reflects the market performance of the world’s top 40–45 fintech companies. Since 2016, the strategy has produced an annual yield of 35%, in USD.

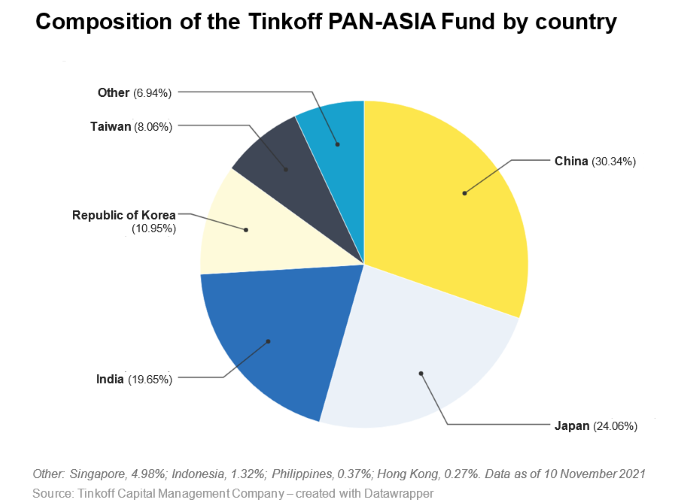

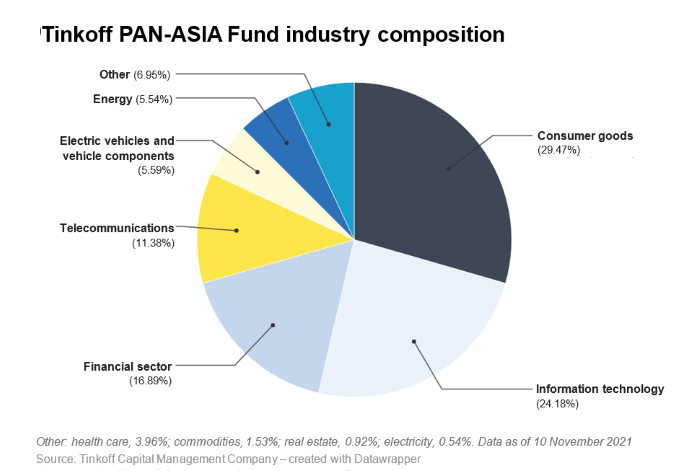

The Tinkoff

The fund follows the Tinkoff PanAsia Total Return Index USD*, which tracks the performance of 50–55

Ruslan Muchipov, CEO of Tinkoff Capital Management Company, said:

«We offer our customers new investment opportunities in

«New technology keeps changing the financial services sector, ousting traditional business models from the market and developing a new industry, fintech. According to experts, the number of financial service users in the world is growing annually by 15%-20% on average. The pandemic has also contributed to the development of the industry by fanning investor interest. In Q1 2021, fintech companies around the world raised USD 22.8 billion. This is almost twice as much as the quarter before. The Tinkoff FinTech Fund pools together the strongest players to gain maximum benefit from further growth in the sector.

«The Tinkoff

The funds are available at all Tinkoff Investments rates. You can buy them without brokerage fees in the Tinkoff Investments mobile app in the «What to Buy» → «Funds» section. You can also buy them through the Tinkoff Investments web interface and web terminal. You will need a brokerage account with Tinkoff to make a purchase. More on how to open an account.

The funds are available at all Tinkoff Investments rates with no brokerage fees for buying and selling units on the Tinkoff

Investments platform.

*Tinkoff PanAsia Total Return Index USD and Tinkoff FinTech Total Return Index USD are calculated by Tinkoff Bank JSC.

The securities and other financial instruments mentioned in this overview are provided for informational purposes only. This overview does not provide investment ideas, advice, recommendations or an offer to buy or sell securities or other financial instruments.

Global Disclaimer

Tinkoff Capital LLC. Licence No. 21-

Before purchasing an investment unit, please carefully read the rules for the mutual fund’s fiduciary management. For detailed information

on Tinkoff Capital LLC and the mutual funds under its management, including trust management rules and all amendments and supplements thereto,

as well as information on applications for the purchase, redemption and exchange of investment units, please contact us at:

5 Golovinskoye Shosse, Bld. 1, Floor 19, Room 19018, Moscow, 125212, www.tinkoffcapital.ru, phone:

+7 499 704 06 13.

ETF RFI Tinkoff Nasdaq Artificial Intelligence. Trust Management Rules No. 4634, registered by the Bank of Russia on 4 October 2021.

ETF RFI Tinkoff Pan Asia Index. Trust Management Rules No. 4632, registered by the Bank of Russia on 4 October 2021.

ETF RFI Tinkoff FinTech Companies Index. Trust Management Rules No. 4633, registered by the Bank of Russia on 4 October 2021.

Related News